Format of Swift Code with examples

A swift or BIC Code is an 8 to 11 digit code that helps identify the country, city, bank, and branch.

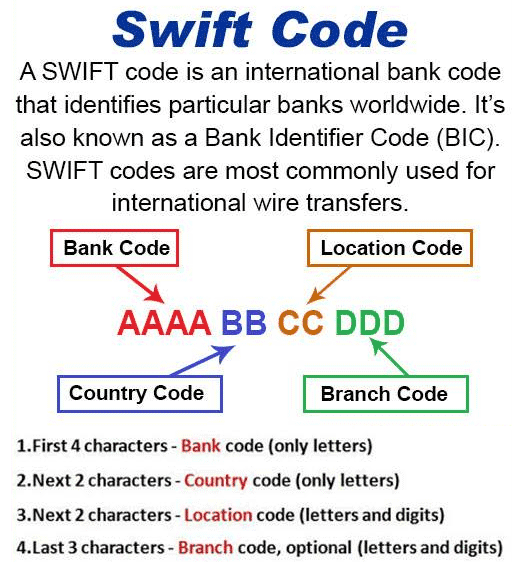

The format of Swift Code:

Bank Code – It is the four letters that represent the bank. You can say it as the shorter version of the bank name.

Country Code – Representing two letters of the country the bank is located in.

Location Code – It is any two characters made from numbers or letters.

Branch Code – Three digits specifying the branch.

Example – Axis Bank: Delhi – Kirti Nagar – Swift Code: AXISINBB250, the branch code here is 250.

Dena Bank: Mumbai – Dadar – Swift Code: BKDNINBBDDR, here the branch code of Dadar is DDR.

How SWIFT Platform Operates?

Swift provides an 11 digit code number to each member institution/ Bank. The first four digits describe the institution, the next two digits the country, and the next two digits the cities where that institution is located. The next 3 digits describe the location of specific branches of the banks and financial institutions. These member institutions can transfer messages through the SWIFT platform for financial transactions in a reliable, secure and fast manner. Thus, this financial transfer is the core of modern business and commerce throughout the globe. However, it should be noted that SWIFT neither holds funds nor transfers any funds, it just provides a platform to facilitate such transfers among member institutions. SWIFT earns money through membership fees and commissions on each financial transaction.

Though there are other similar platforms like SWFIT in the world: Fedwire, Ripple, Clearing House, and Interbank transfer system (CHIPS), SWIFT dominates the financial messaging market in the world. Over the years, SWIFT has diversified its services and customers and expanded its market.

What is SWIFT Ban on Russia?

SWIFT ban simply means removing the Russian banks and institutions from the SWIFT Society and platforms. Thus, Russian institutions and banks will not be able to utilize SWIFT platform harming their trade and commerce and external financial transactions. The decision to remove Russian banks from SWIFT was taken on 28 February 2022 in wake of its Ukraine invasion by the Group of 10 (G-10) countries. The G-10 has the power the oversee the functioning of SWIFT. The G-10 includes North America, some EU countries and Japan. The G-10 includes practically now 11 countries-Canada, US, UK, France, Belgium, Germany, Netherlands, Switzerland, Italy, Sweden and Japan. All of these countries are in favour of imposing sanctions against Russia.

How Russia can Overcome SWIFT Ban?

Russian transactions with the members of the SWIFT and through SWIFT platform will be affected. But Russia can use another platform to overcome its financial difficulties. Alternatively, it can make currency swapping arrangements with select to bypass SWIFT transfer. For example, the Rupee-Rouble trade is one such mechanism to avoid the use of SWIFT platform. But in general, SWIFT ban will have a negative impact on Russian trade and commerce.

Russian transactions with the members of the SWIFT and through SWIFT platform will be affected. But Russia can use another platform to overcome its financial difficulties. Alternatively, it can make currency swapping arrangements with select to bypass SWIFT transfer. For example, the Rupee-Rouble trade is one such mechanism to avoid the use of SWIFT platform. But in general, SWIFT ban will have a negative impact on Russian trade and commerce.

0 Comments